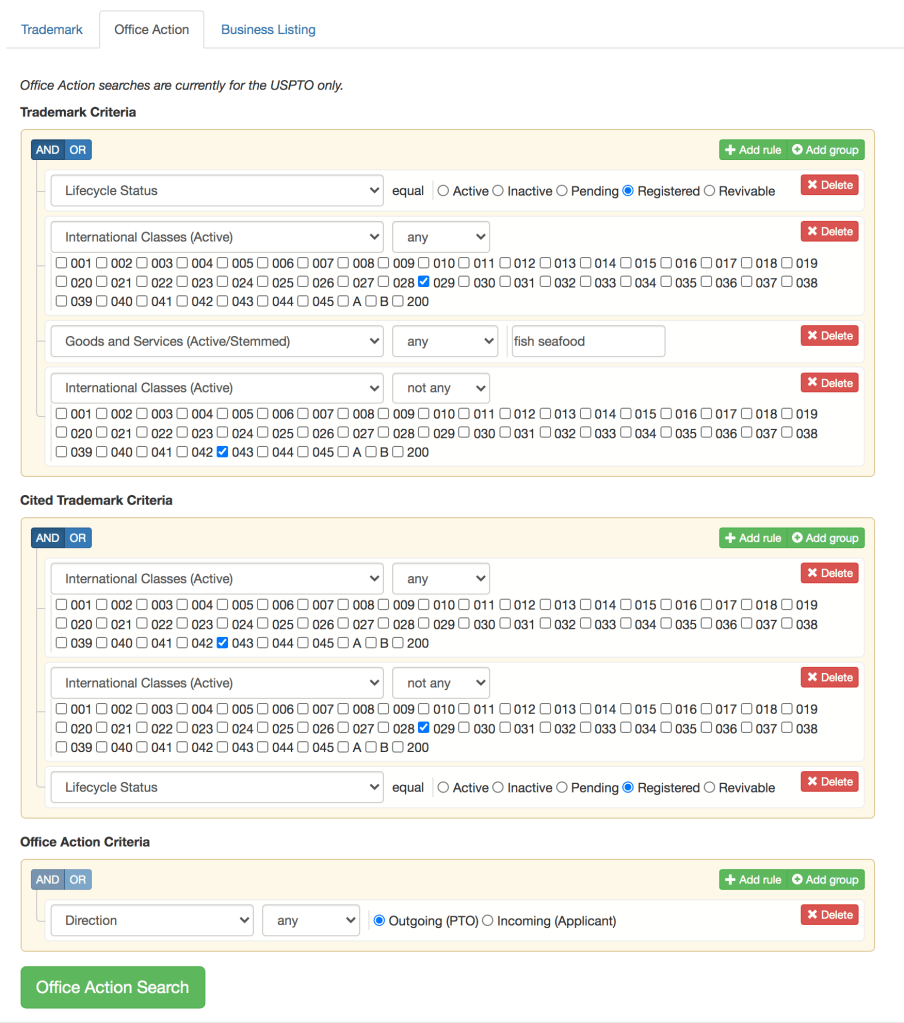

As a trademark practitioner, you know that not all Office Actions are created equal. If your Office Action just raises an issue with a specimen or a disclaimer request, there may be some back-and-forth with your examining attorney, but the issue will almost certainly get resolved sooner or later. You can get a feel for how likely an issue is to be resolved prior to publication with our Office Action analysis tool and the Examiner analytics it provides.

If, however, you run into a functionality refusal or a likelihood of confusion refusal, you’re likely looking at at least one round of substantive back-and-forth. Applications running into these sorts of refusals move forward to publication at a much lower rate, as we’ve detailed in some prior blog posts.

What sort of refusals, then, did the USPTO tend to issue in 2022? The big ones were:

| Substantive Refusals | |

| Likelihood of Confusion | 23% |

| Descriptiveness | 18% |

| Non-Substantive Refusals | |

| Specimen | 30% |

| Classification | 25% |

| Disclaimer | 22% |

| Mark description | 14% |

| Domicile | 12% |

Foreign registration-related suspensions and applicant entity clarification requests were present in around 4% of Office Actions each. No other issue exceeded 2% frequency.

A few interesting points arise from this data, particularly the large numbers of non-substantive refusals.

The Office Should Change the Process for Assigning Mark Descriptions. Mark description issues are far more common than I expected. It might be more efficient for the Office to simply assign mark descriptions and allow applicants to object, similar to the process for design codes. That process is highly effective, and applicants rarely push back on the Office’s preferred design coding (or, indeed, the description of the mark phrasing). The change of process would permit some otherwise perfectly acceptable applications from either going abandoned for lack of a response, and speed examination time for almost all of the rest.

Classification Issues Aren’t Going Away. The heavy incentives towards TEAS Plus filing are not enough to eliminate identification woes. While the Office’s ever-widening price gap between TEAS and TEAS Plus is an attempt to mitigate this issue, it can’t solve the whole problem — indeed, it will never solve the issue for any Madrid-based applications. Only further efforts to create a worldwide equivalent of the ID Manual would not only help speed up prosecution in the US, but could address the maddening inconsistencies between what constitutes an acceptable definition goods in various countries. If WIPO could incentivize (e.g. through filing fees) use of such “universally accepted” language, it would be a big improvement for the international trademark system.

Disclaimer Practice is a Drag. Disclaimer requests are really, really common, popping up in over a fifth of Office Actions. Disclaimer practice in the US is riven with inconsistencies; the same term showing up in a short mark will get a disclaimer request; if the mark has a pun in it or if the term is used in a tagline that’s barely any longer, it’ll avoid a disclaimer request. It’s all very silly.

There has to be a better way. A simple, hard-and-fast rule would remove much of this back-and-forth. For example, the Office could adopt a rule that a term that is used in active registrations more than X times (3? 5?) by different owners in a single class is presumptively not likely to cause confusion with another mark, unless there is other evidence of mark similarity like other terms in the mark, visual presentation, etc. That would have two big benefits. First, it would dramatically simplify the confusion analysis. (As a side effect, it would stop the Office from issuing the annoying refusals where 6 companies own registrations for TERMX + SECOND TERM, someone slips through a registration for TERMX alone for narrow goods, and then every subsequent applicant for TERMX + SECOND TERM style marks gets a 2(d) refusal that they have to fight about.) Second, it would obviate the need for disclaimer practice. Just count!

As with mark description issues, some otherwise perfectly fine applications are either going abandoned over disclaimer requests, or have to deal with extra attorney fees to reply (and increased total prosecution time). Neither are a good outcome, and the Office should consider a wholesale revamp of the disclaimer practice to fix it.

Conclusion. Hopefully, we’ve not only given you some insight on the types of issues applicants are running into most often, but also provided some interesting ideas about how the Office could revamp its existing processes to better avoid unnecessary prosecution problems.