“Color” marks are a bit of an oddity for trademark professionals — a color or set of colors applied to a product, packaging, or the means of providing a service that has a source-indicating function rather than a merely decorative importance.

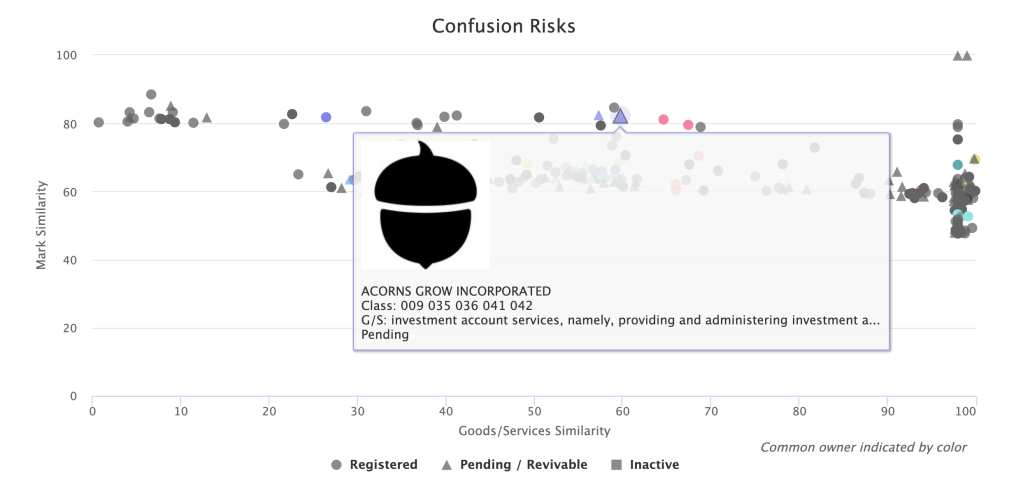

These are difficult to search for, even using advanced AI models — like our new AI search tool! You should try it; it’s awesome!, because the mark can be displayed in several ways that look very different from each other: (1) a color swatch or swatches, (2) a drawing of an object to which the color is applied, shown in color, and (3) a drawing of an object to which the color is applied, but with stippling serving as a “code” for the color, and (4) multiple views of (2) or (3) in a single filing. Furthermore, the various angles and ways the product in (2)-(4) could be displayed could end up looking fairly different but are still representing the same mark.

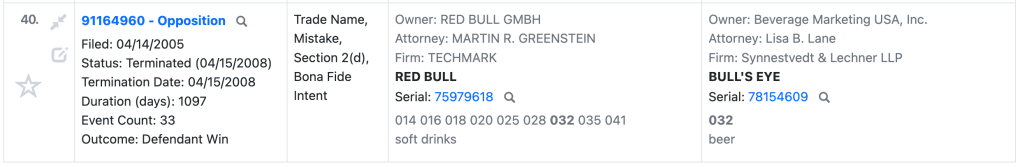

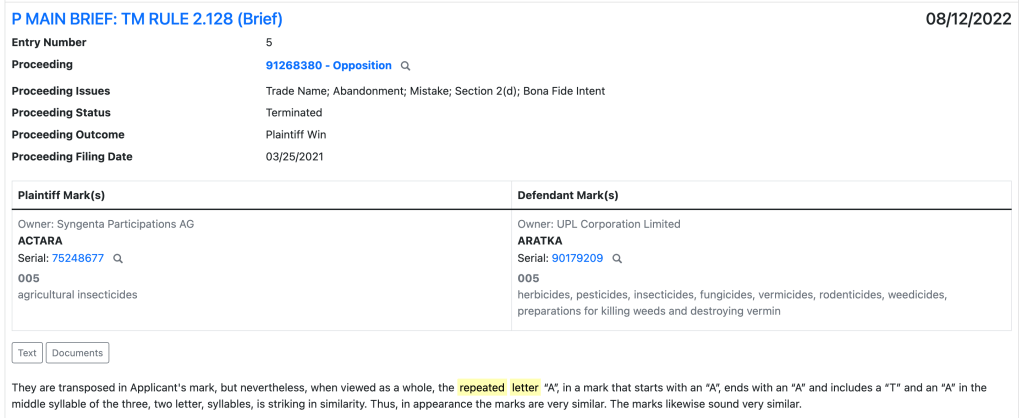

One significant complication is that the USPTO and most other trademark offices deal with color marks differently, from a data perspective. Many jurisdictions around the world include a data point, which we store in the “Feature Type” field for manual searches, that identifies color marks, sound marks, holograms, smells, etc. While this data coding isn’t perfect, and often has things tagged that actually aren’t true “color” marks, it’s still pretty good and very convenient. And then there’s the UPSTO, which… doesn’t.

Instead of a single, nice, clean variable, the USPTO jams indicators that identify “color” marks into its design coding system. This is actually one of the biggest ways the USPTO design codes differ from the Vienna design code system. In the Vienna system, codes starting with 29 are just color identifiers. The mark is a pig logo that has some pink in it? Great. 29.01.01. In the USPTO, it’s a lot more complicated — the pink in the pig may only show up as a part of the color claim and/or the mark description. Instead, the color-related design codes in section 29 replicate the “color” mark boolean that is much more efficiently conveyed in other jurisdictions. The tradeoff is that the USPTO provides a little more depth, with separate categories for (a) single-color and (b) multi-color marks, (b) used on the entire items or (c) just a part of it, and for those color marks (d) used on products or items used in providing for services and (d) used on packaging or (e) other advertising, and the various combinations of these three sets of values.

So, how do you do this in TM TKO? Let’s pretend that your client is a pharmaceutical manufacturer, and has asked if they can obtain protection for a “color” mark that is a bright yellow pill (or, if not, a yellow stripe on a pill). In the US: https://www.tmtko.com/searches/2938217 for yellow just on product, or https://www.tmtko.com/searches/2938215 for any yellow on products/packaging. Internationally, it’s simpler — something like https://www.tmtko.com/searches/2938219, for a similar yellow in the EU. (And, yes, I picked yellow because it’s relatively less common.)

Happy searching!