Today, we’ll take a look at “primarily merely a surname” refusals. Section 1052(e)(4) of the Lanham Act limits registration where the mark is “primarily merely a surname.” TMEP § 1211.01. To make a determination about whether consumers will perceive the mark as primarily merely a surname, the Office will consider:

- (1) whether the surname is rare;

- (2) whether the term is the surname of anyone connected with the applicant;

- (3) whether the term has any recognized meaning other than as a surname;

- (4) whether it has the “structure and pronunciation” of a surname; and

- (5) whether the stylization of lettering is distinctive enough to create a separate commercial impression.

In re Benthin Mgmt. GmbH, 37 USPQ2d 1332, 1333-1334 (TTAB 1995). The first and third tend to be the most frequent points of dispute.

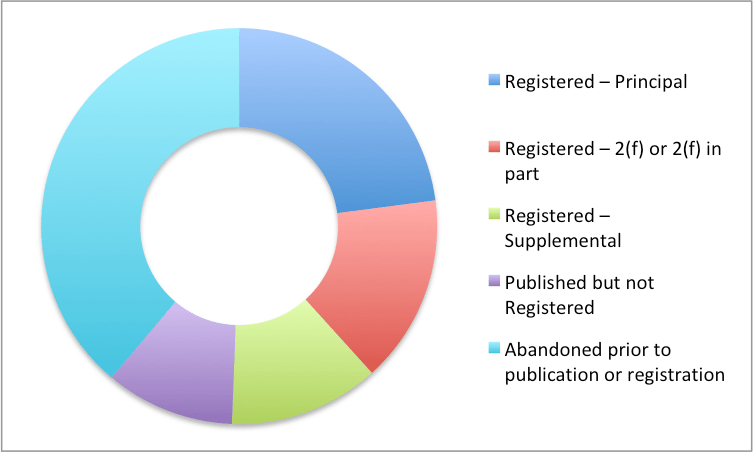

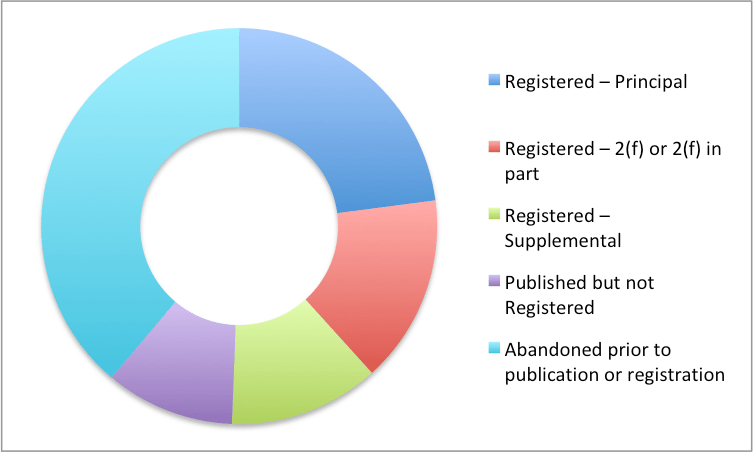

Since 2010, the Office has preliminarily refused over 53,000 marks on 2(e)(4) grounds. Just shy of 40% of applications that received this refusal were abandoned prior to publication. The rest resolved the issue in one way or another, resulting in either registrations the Principal Register (~23%), registrations with a 2(f) claim in whole or in part (~15%), registrations on the Supplemental Register (~12% each), or applications that were abandoned after publication (~10%). In all, that’s about half of applications where the mark was accepted as inherently or practically distinctive, and half where the refusal held up.

1. Whether a Term is Rare

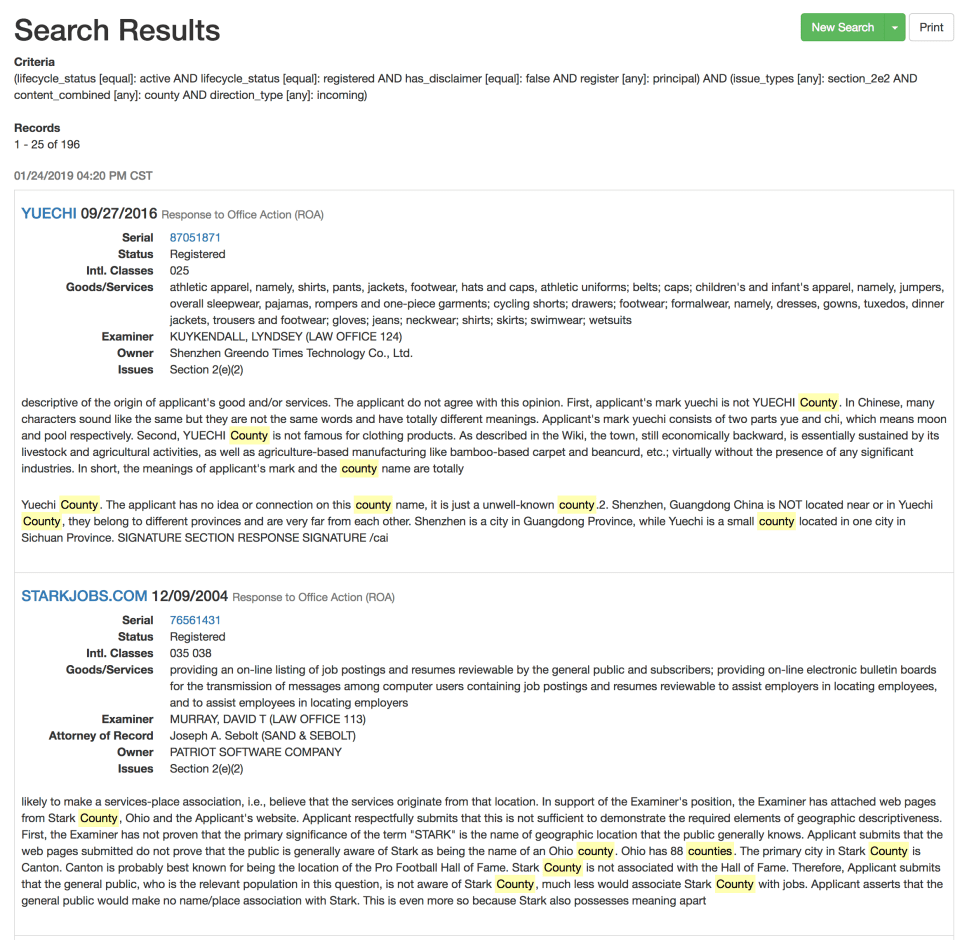

Whether a term is “extremely rare” depends on the facts. TMEP 1211.02(b)(i). The Trademark Trial and Appeal Board has found that 456 instances of a surname in the United States were “extremely rare” and unlikely to be perceived as a surname by customers. In re Joint-Stock Company “Baik”, 84 USPQ 2d 1921, 1923 (TTAB 2007). Using TM TKO’s Office Action research tools, it’s quick to find other examples of refusals based on low numbers being overcome, such as HOSS (100 times), AQUARO (a bit more than 100 times), FAUCHER (40 times), and more. Some of these refusals are frankly pretty bad – HOSS, in particular, has an obvious “recognized meaning other than as a surname” and should never have generated a 2(e)(4) refusal.

Strange surname refusals are surprisingly common. ZENGAGE, LONGFRI, MAGOS, VIVINO, JARDINE, and even ADEPTUS generated a surname inquiry (if not outright refusal). The consistency of the surname refusal examination appears to leave something to be desired, especially as applied to foreign terms that are primarily understood as normal words rather than surnames.

2. Whether a Term has a Recognized Meaning other than a Surname

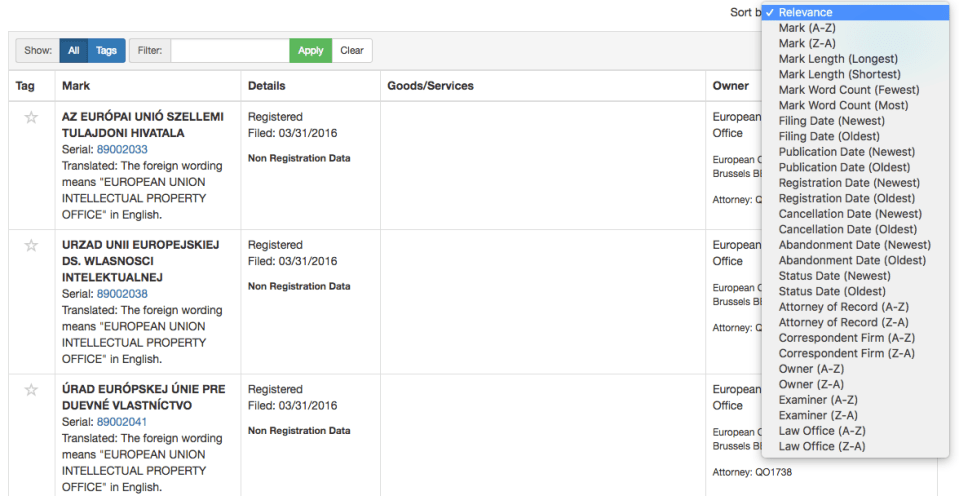

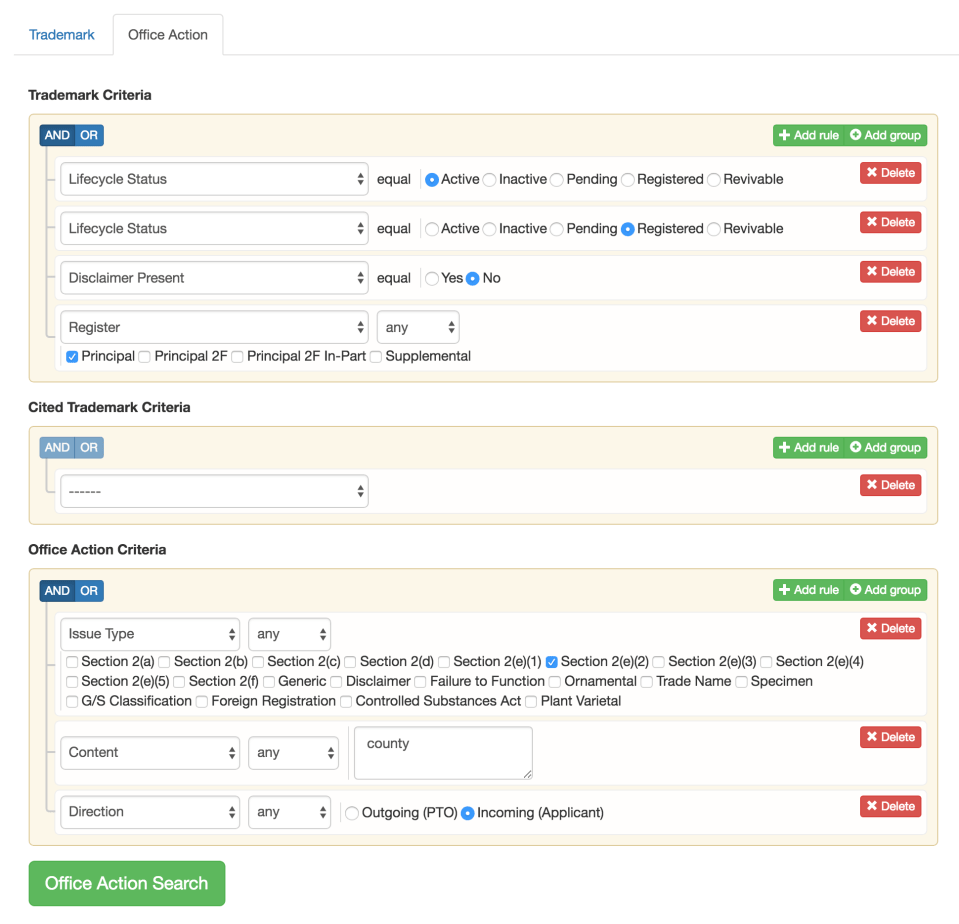

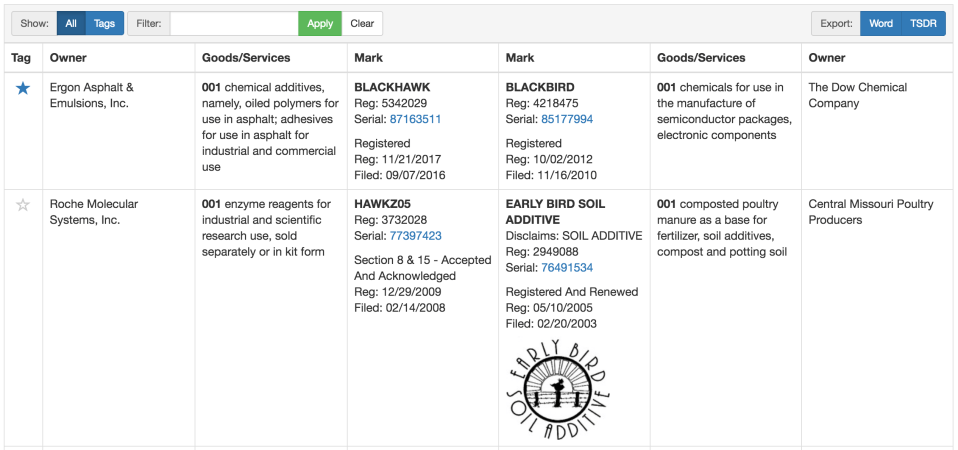

By using TM TKO’s free-text Office Action Response search and TTAB case research, we can identify a few interesting types of “recognized meanings” that the Examining corps has accepted.

– It is a surname, but one that primarily has historical import. See, e.g., a successful Office Action Response for MEDICI, Ser. No. 86724819, a successful Office Action Response arguing that CASSINI suggests the scientist behind a mapping system and not a likely surname of the provider, Ser. No. 85523416, and a successful TTAB appeal for ROMANOV, In re The Hyman Companies Inc., Ser. No. 85483695 (TTAB June 4, 2015) (not precedential). The applicant for VICKERS for gin even successfully argued that a name based on two early 19th century distillers of the same name was sufficiently historical, Ser. No. 86365318.

– The term is also used as the identifier for a city or geographic region. See, e.g., a successful Office Action Response for STRATTON, Ser. No. 85299672. These arguments are always somewhat funny to me for two reasons. First, they point to potentially different grounds for a 2(e) refusal. Second, the cities or counties (or business names) that applicants are using as evidence tend themselves to be based on or derived from surnames. However, these types of arguments are frequently successful.

– Pointing out that a term is both a surname and a given name is frequently successful, e.g. in responses for HAYDEN’S BAR AND GRILL, Ser. No. 77818198, and a successful response for CONNELLY, Ser. No. 85583934.

Need to do More Research?

If you need more specialized research to overcome a surname refusal, please log in and start searching if you are already a client or sign up for a free trial if not. Either way, please don’t hesitate to reach out to us for any questions or research help.