For the past two weeks, TM TKO ran a survey about how trademark professionals are feeling about their practice in 2021. We’ll summarize the results in this blog post. Thanks to our users and to participants on Oppendhal Patent Law Firm’s e-trademarks listserv for their responses!

About TM TKO

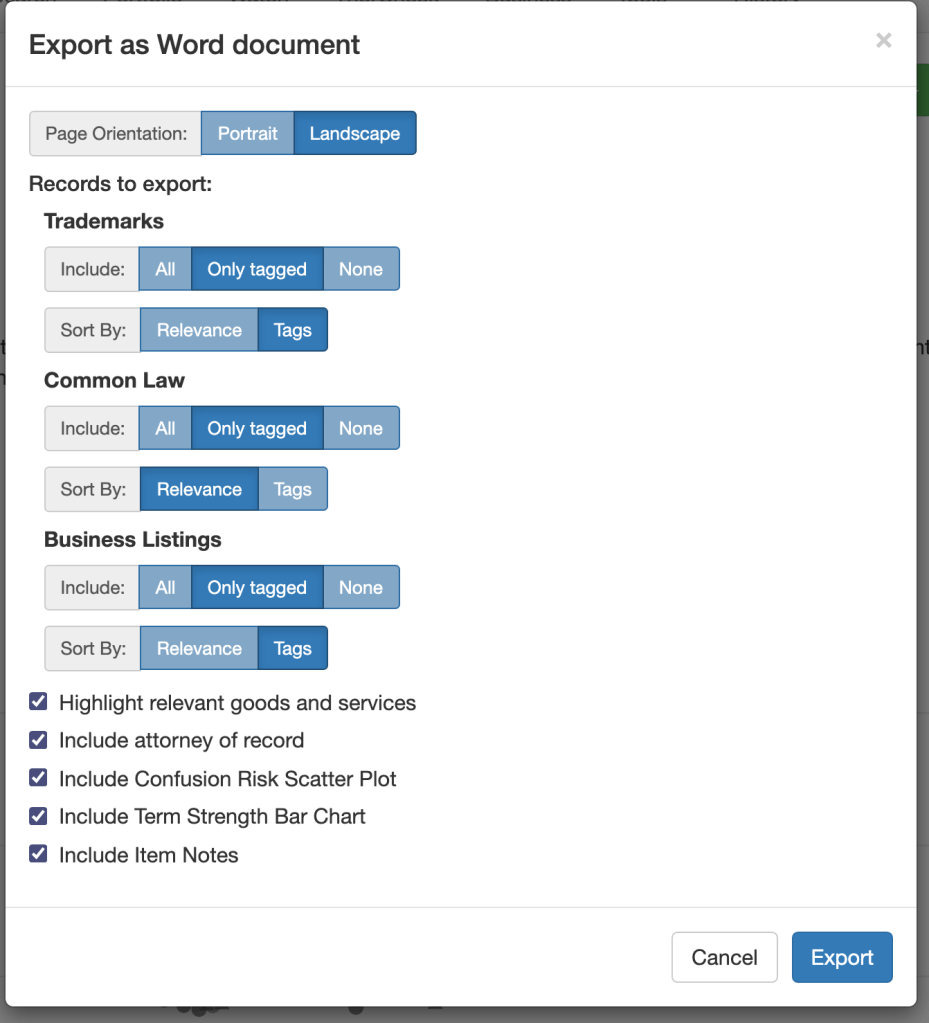

A very quick word about us – TM TKO has been providing daily or subscription-based access to a variety of trademark research tools since 2015. Our customers include AmLaw 100 firms, trademark boutiques, solo practitioners, government agencies, in-house counsel, and more. We had our best year ever as a company in 2020, even if the year posed its challenges to us all as humans, and are looking forward to 2021. Our data covers the US, CA, MX, AU, NZ, EU, FR, DE, ES, the UK, and WIPO.

We aim to help trademark lawyers with three main pillars of all successful trademark practices: solving everyday problems, solving hard problems, and growing practices.

Everyday problems: our clearance, search, and watch tools help you with your day-to-day practice needs. Hard problems: specialized research tools like trademark Examiner analytics, automated and manual Office Action research, and comparative research via ThorCheck® can help overcome difficult prosecution refusals. Growing your practice: we have an expanding set of marketing solutions to help grow your client base and generate more projects for existing clients.

Haven’t used TM TKO yet? It’s free to try for 30 days.

To the Results!

Trademark Practice – Size and Geography

Our respondents were almost evenly split between solo and 2-5 lawyer IP practices, with about 20% in larger groups.

About 40% of respondents were from the east coast, 15% from the south, and the rest almost evenly split between the west and southwest. All but a couple of respondents were American lawyers. Of those, about 50% were in large cities, with the rest evenly divided between small and medium size cities.

Expectations for 2021

Two-thirds of attorneys are looking forward to 2021 being better than 2020, with most of the rest expecting a similar year. Unsurprisingly, given what a mess 2020 was in the real world, not too many expect the rest of 2021 to be worse than 2020!

Most respondents were neutral or optimistic about their personal practices, and most saw the greatest growth in small and midsize clients versus large companies. Large company work was the fastest-shrinking, among respondents.

Litigation and international prosecution slowed down the most; domestic prosecution and non-litigated dispute work were the most consistent growth areas. Transactional work and international prosecution work had about the same numbers of respondents who saw growth incoming and shrinkage, so there was no clear trend of those practice areas.

About two-thirds of respondents are seeing most of their new work come from existing clients, with referrals from in-country clients, business development efforts, and referrals from foreign counsel each attracting about half-as-many respondents as the new-work-source before it.

Remote work and professional growth in a post-Covid world.

About 40% think that the future will see more remote work than in the past, and another 20% expect continued remote work. Others didn’t move to a remote model anyway, it would be a temporary issue, or aren’t sure how this will play out. Of those expecting more remote work, around 30% was because employees prefer it, about 10% because management does, and about 14% see cost savings on office space as a benefit.

Almost two-thirds or respondents attend INTA in normal years, with other conferences or state bar meetings each racking up over 20% of respondents. Only about 40% plan to attend INTA this year, a pretty good drop; “other” events saw some growth (online CLEs?), and state bar meeting attendance rates seem likely to stay pretty constant. Perhaps it makes some sense that people are currently leery about attending highly international conferences in a world where vaccine distribution is far from equal; this may change as the year moves along and (hopefully) that situation changes.

Practice challenges in 2021

Perennial favorites like staffing issues, client acquisition, the cost structure of a process (and commoditization of it, on the flip side), and price pressures all received at least 20% of responses. Client retention and technology were, comparatively, minor worries.

Technology

Search, watch, and docketing were pretty ubiquitous, with IP investigative services at around 40% of respondents. Anti-piracy/counterfeiting services (2%) and trademark renewal services (2%) were far less frequently used by our respondents. Most practitioners kept their technology services pretty constant in 2020, and plan to do so in 2021 too.

Practice and the USPTO

About half of respondents replied that the USPTO hasn’t improved anything in the last several years, with occasional plaudits for website usability, 2(d) prosecution decisions, and TTAB decisions. Almost half of respondents think that 2(d) refusal decisions have gotten worse, and about a third found degradation in 2(e) refusals and other prosecution decisions. The TTAB was the least-listed, although whether that reflects on the merits of the Board’s decisions or just the fact that most practitioners don’t directly interact with the Board on a regular basis is beyond the scope of the survey.

Other comments

Our free-text comments focused on several common threads:

– unhappiness with the USPTO, both with its technology and the rate and thought processes behind 2(d) refusals

– dissatisfaction with the number of registrations that get through with iffy-to-fake specimens, and the greater amount of pushback that practitioners feel they are getting for specimens that have historically been acceptable.