TM TKO is happy to announce that we have launched 10 new jurisdictions in our trademark clearance, watching, and prosecution research platform, more than doubling the number of searchable trademark records in TM TKO. TM TKO now covers the primary trademark filing jurisdictions for nearly 1 billion people worldwide, and provides partial coverage for nearly 100 additional jurisdictions via WIPO International Registration data.

The new countries and jurisdictions:

- North America: Canada, Mexico

- Europe: the European Union IP Office (EUIPO), France, Germany, Spain, the United Kingdom

- Oceania: Australia, New Zealand

- Global: the World Intellectual Property Organization (WIPO)

The new jurisdictions are already integrated into TM TKO’s smart clearance search system, its watching and automated watch Portfolio setup tools, and its groundbreaking ThorCheck® prosecution and dispute research engine.

If you already enjoy using TM TKO, let your local counsel in these jurisdictions know to give us a try! If you have never tried TM TKO, or if you haven’t tried TM TKO lately, we’d be happy to show you all the new features. Email us at inquiries@tmtko.com to set up a time to talk. We have a free 30 day trial, and always have free training and support.

How Does TM TKO’s Smart Clearance Work?

Just enter your client’s mark and core products, and TM TKO will come up with the hundreds of search strategies needed to identify relevant marks and weight them appropriately. Let’s say your client is planning to use the mark UNSTOPPABLE FLAVOR, and wants to clear it in New Zealand and Australia.

A bar graph will show you how TM TKO weights the component parts — it’s paying much more attention to UNSTOPPABLE than FLAVOR, since flavor is fairly diluted and the term shows up frequently in descriptions of goods.

TM TKO also plots out confusion risks to help you move through your analysis more quickly. More similar marks are plotted up the vertical axis, and more similar goods plotted horizontally. Here, a pair of registrations (shown in the same color to make families of marks stick out more) for UNSTOPPABLE for cereal owned by Kellogg, one in AU and one in NZ, stick out, with a registration for LITTLE BOTTLE OF UNSTOPPABLE for custards owned by Parmalat a bit to its left. Further down to the right, a bunch of marks including FLAVOR for coffee co-exist. Further down the report, you’ll also have a traditional table with full details of the results; this chart just provides a quick visual overview to speed up your review.

Our international expansion also sees us add improved translation options and data, for both the marks you are searching and underlying trademark registry data.

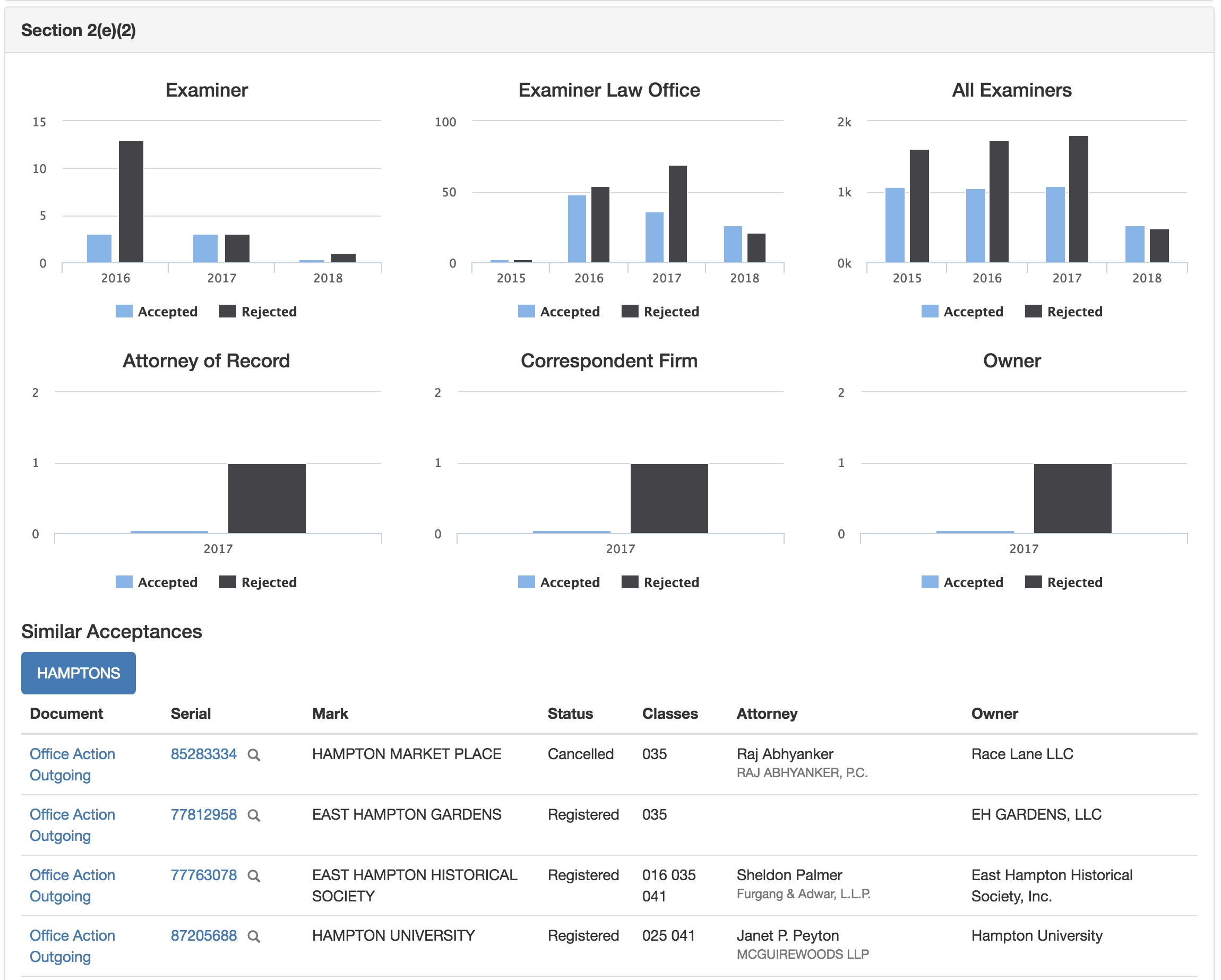

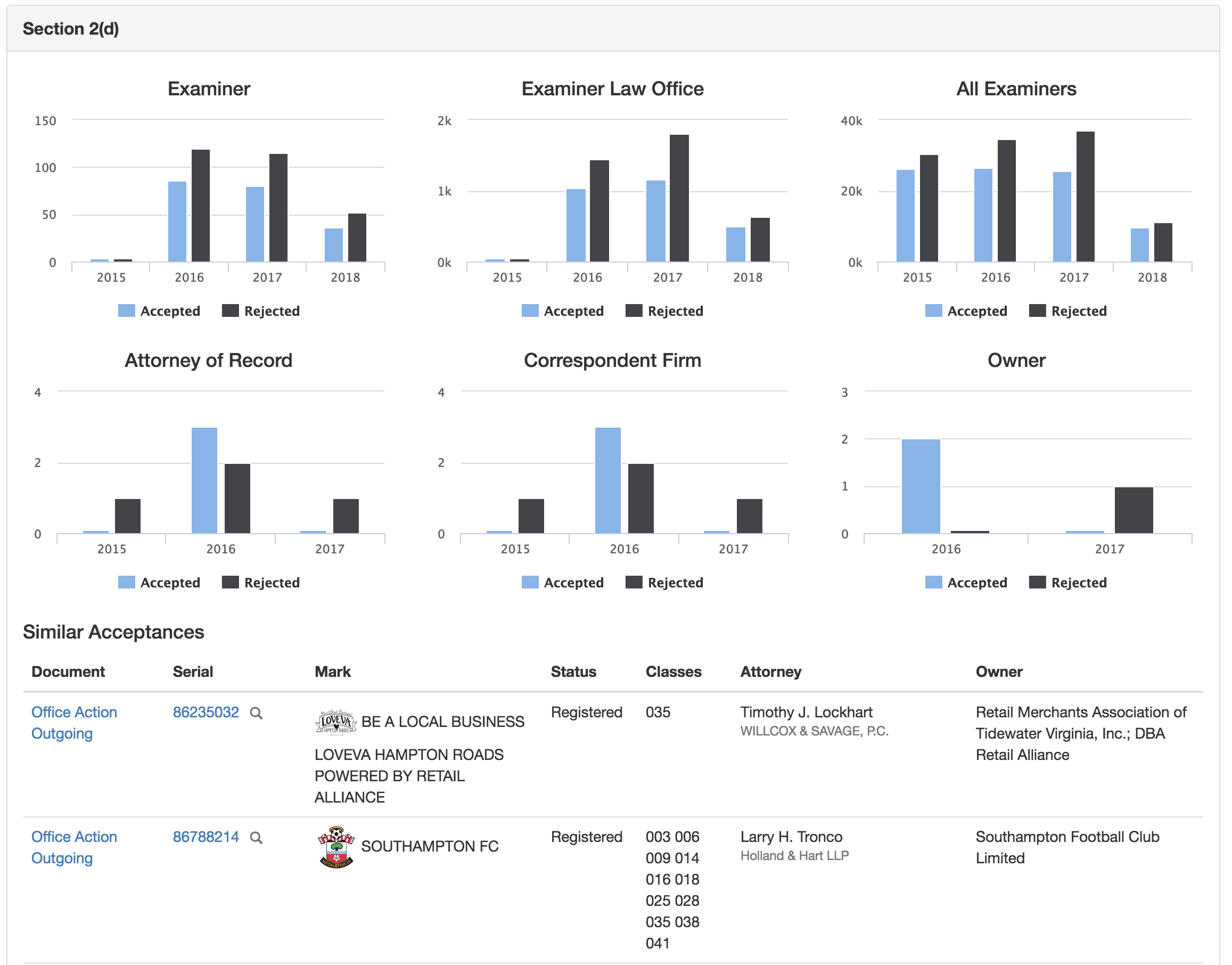

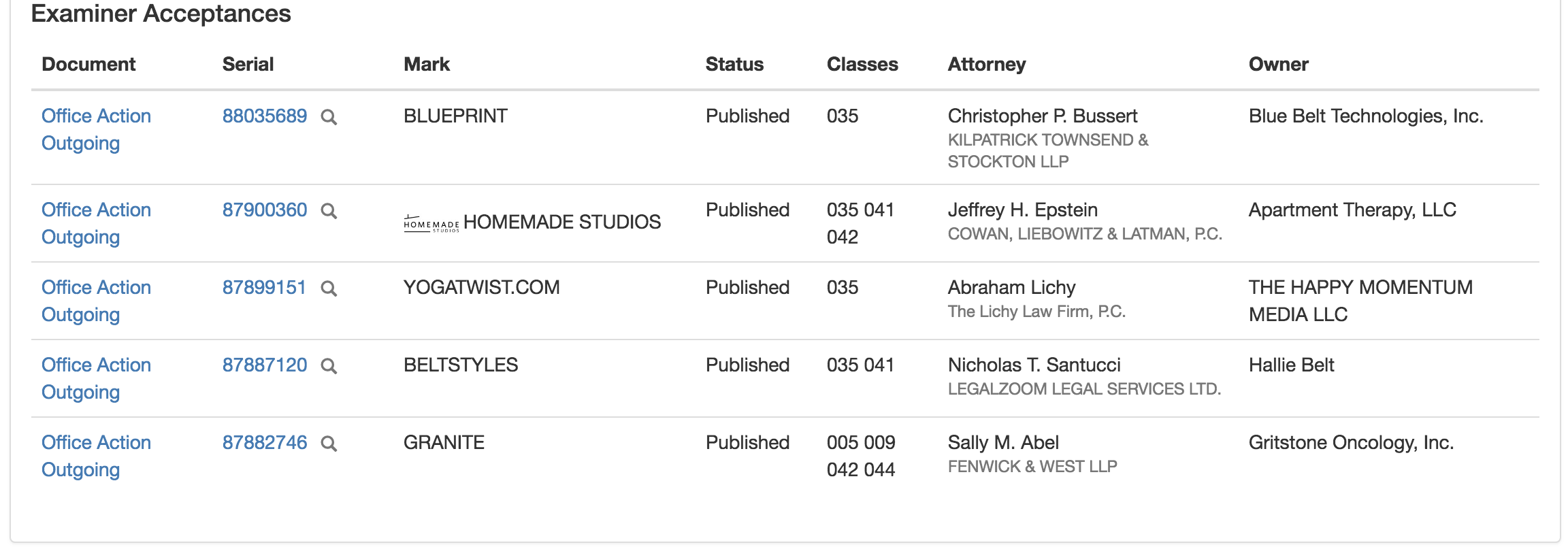

What Is ThorCheck?

ThorCheck is an analytical engine that will find evidence to support arguments for or against likelihood of confusion refusals (for jurisdictions with substantive ex parte examination) and oppositions (everywhere). You can use it in two ways: first, to analyze the strength of your arguments, and second, to generate evidence to support those arguments.

Using ThorCheck for Analysis. The ThorCheck report also gives you analysis about overlap — in addition to these examples of co-existence, how often does a single company own registrations that cover both goods? Here, there are both a number of examples of “intersection” — same mark and owner for both sets of goods — and “dissimilarity,” where different companies have happened to select identical or similar marks. (That count is typically lower because it relies on some chance.) This can help you analyze the strengths and weaknesses of your position.

Let’s say you are EU trademark counsel for a skateboard company. Your application gets opposed by a prior registration for a fairly similar mark for bicycles. ThorCheck can help! Plug in skateboards on one side and bicycles on the other, and you can get a read as to how much evidence there is on either side of the “related goods” question.

As for the evidentiary piece, ThorCheck will find examples of identical or similar marks with different owners, one for skateboards and one for bicycles. This can help you mount a convincing argument that the two sets of goods and services are not so closely related that confusion is likely — demonstrating actual market co-existence can really move the needle.

| Owner | Goods/Services | Mark | Mark | Goods/Services | Owner |

| Globe International Nominees Pty Ltd | 028 skateboards | globe Reg: 003201365 Serial: 003201365 Registered Reg: 12/01/2004 Filed: 07/01/2003 | GLOBE Reg: 000852731 Serial: 000852731 Registered Reg: 02/06/2001 Filed: 06/09/1998 | 012 bicycles and tricycles | Globe motem LLC |

| Emu Ridge Holdings Pty Ltd | 028 skateboards | EMU Reg: 003611787 Serial: 003611787 Registered Reg: 07/08/2005 Filed: 01/29/2004 | EMU Reg: 013423652 Serial: 013423652 Registered Reg: 05/20/2015 Filed: 10/31/2014 | 012 bicycle trailers | Emu Electric Bike Company Limited |

| WaterRower Inc. | 028 skateboards | SHOCKWAVE Reg: 011254761 Serial: 011254761 Registered Reg: 11/10/2013 Filed: 10/10/2012 | SHOCKWAVE Reg: 005208376 Serial: 005208376 Registered Reg: 06/21/2007 Filed: 07/19/2006 | 012 bicycles | Halfords Limited |

| LUCA BRESSAN | 028 skateboards | SOLO Reg: 011012598 Serial: 011012598 Registered Reg: 05/10/2013 Filed: 07/04/2012 | SOLO Reg: 002999464 Serial: 002999464 Registered Reg: 09/10/2004 Filed: 01/08/2003 | 012 bicycles and bicycles frames | Industries RAD Inc. |

| DONGGUAN AIXI INDUSTRIES LIMITED | 028 skateboards | BLITZ Reg: 011078151 Serial: 011078151 Registered Reg: 06/13/2013 Filed: 07/27/2012 | BLITZ Reg: 010777431 Serial: 010777431 Registered Reg: 09/18/2012 Filed: 04/02/2012 | 012 bicycles | Sodibike Comercio De Artigos Esportivos LTDA |

| Sport-Tiedje GmbH | 028 skateboards | TAURUS Reg: 006236889 Serial: 006236889 Registered Reg: 01/28/2011 Filed: 08/29/2007 | Taurus Reg: 010303758 Serial: 010303758 Registered Reg: 03/30/2012 Filed: 09/30/2011 | 012 bicycles | BBF Bike GmbH |

| Firewire Ltd | 028 skateboards | FIREWIRE Reg: 007188022 Serial: 007188022 Registered Reg: 05/11/2009 Filed: 08/26/2008 | FIREWIRE Reg: 011619293 Serial: 011619293 Registered Reg: 07/25/2013 Filed: 03/01/2013 | 012 bicycles | Ison Distribution Ltd. |

| TRIBALIST LTD | 028 skateboards | RIDGE Reg: 012944501 Serial: 012944501 Registered Reg: 09/29/2014 Filed: 06/06/2014 | RIDGE Reg: 008838658 Serial: 008838658 Registered Reg: 07/27/2010 Filed: 01/27/2010 | 012 bicycles | Halfords Limited |

This evidence can turn the tide in a difficult opposition, by providing you registry-based evidence of the type of co-existence that your counter-party suggests will cause consumer confusion.

ThorCheck isn’t just for goods/services comparisons! You can also use ThorCheck to find co-existing marks that differ by a single term (i.e. marks that are identical or very similar, except one has STUDIO and one doesn’t), or find registrations with two terms that co-exist (like HAWK and BIRD) in a class.

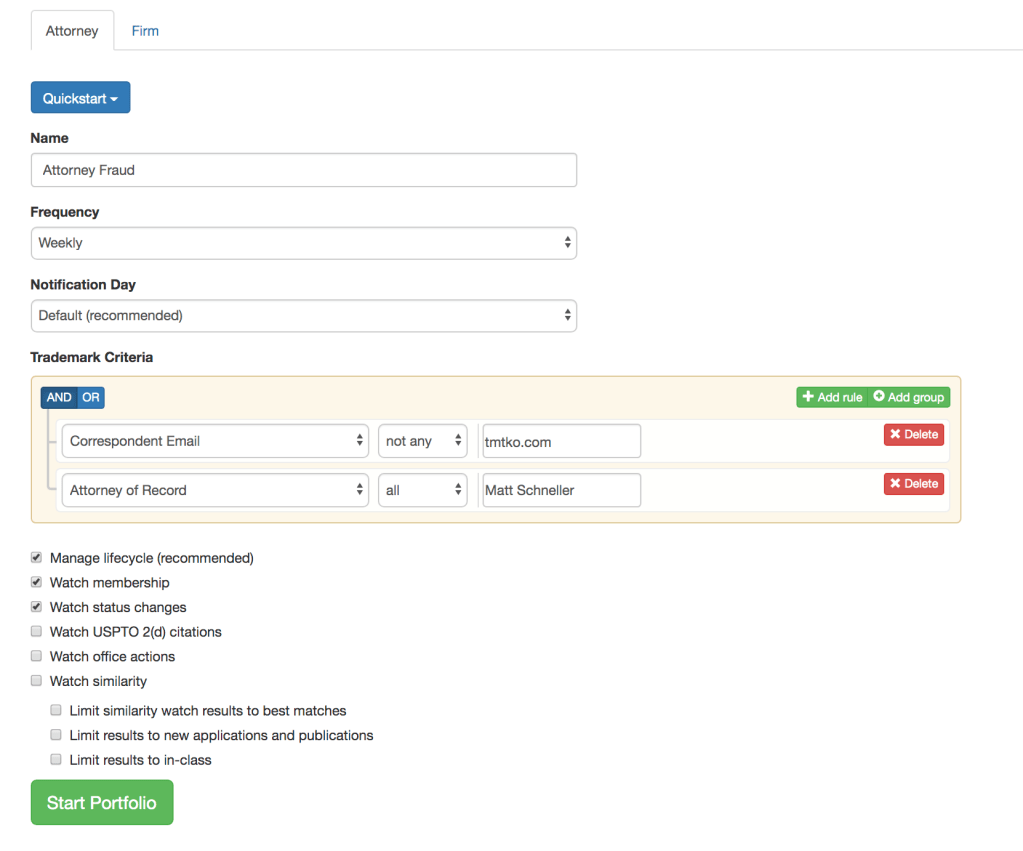

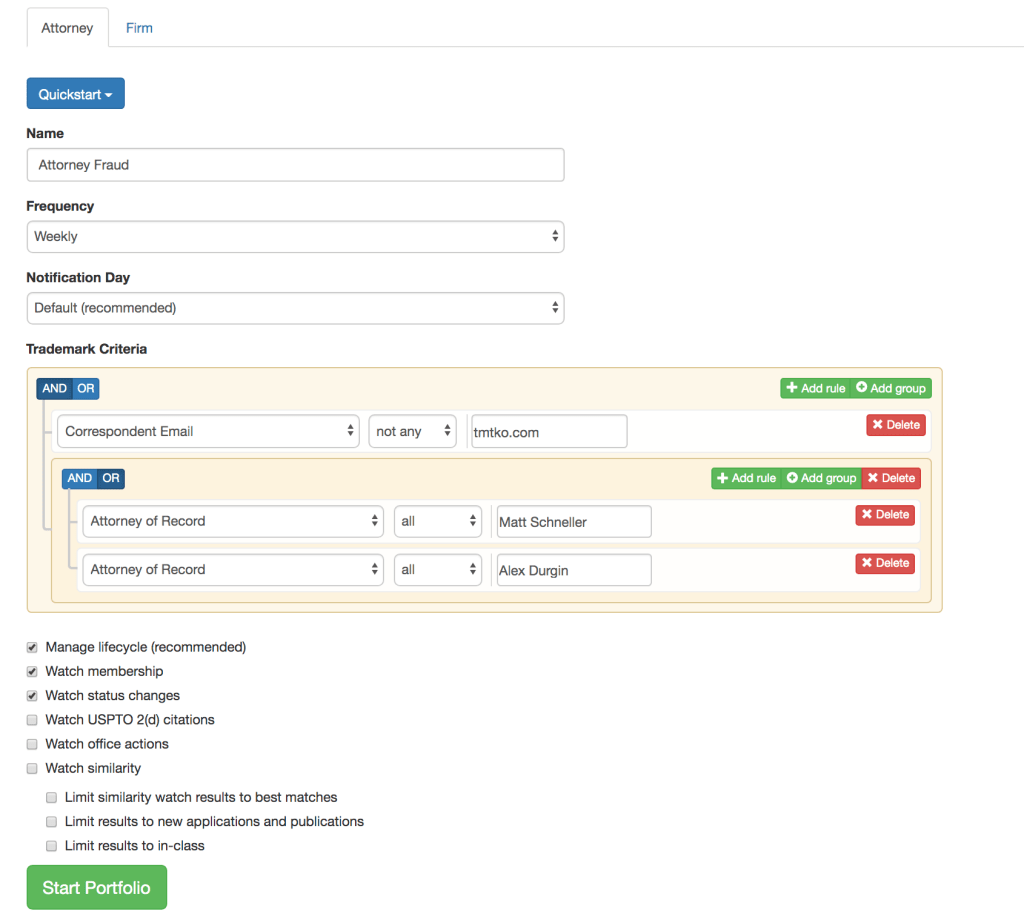

How Does TM TKO Approach Watching?

All subscriptions to TM TKO include unlimited watching, built on its smart clearance engine. As a TM TKO user, the days of having to sell clients on hard vendor costs to get them to move into a watching regime are over. Protect them and generate valuable work opportunities for you practice!

It is easy to set up a watching portfolio based on your firm name, email address, or a client name or names, depending on what information your “home” country provides. We provide an initial training session to help you get your watching set up to your specifications, and you can reap the rewards.

If You Aren’t a TM TKO User: Try For Free!

TM TKO comes with a free 30-day trial to make sure that our tools match the way you prefer to work. We’re happy to set up a web meeting to walk you through all of the tools and get your watching set up, so you get the full value out of the platform.

If you decide to use TM TKO post-trial, you have two options. First, a $75 daily pass that provides 24 hours of use of anything but watch, for more transactional research projects. Second, a subscription that also provides unlimited watching. Subscriptions are $250/mo or $2500/yr for one seat, and prices increase gradually for additional seats — for example, 5 seats are $500/mo or $5000/yr.

Current TM TKO Users: What Does This Expansion Mean for You?

You get a whole lot more features for exactly the same price tag! We don’t have any jurisdictional gating or other pricing-driven access limitations. If you are a TM TKO user, you now have access to all this new data.

The easiest way to take advantage of the new international watching features is to set up a new Portfolio or Portfolios for your multinational clients’ key marks. We will have a blog post up shortly to walk you through that process.